Are you getting all you can out of your DeFi yield farming? Learn to auto compound crypto returns, and supercharge your investment.

February 3rd 2022| Mike Humphrey

Table of Contents

What is Auto Compounding

Auto compound crypto protocols are DApps that automatically collect and re-invest rewards you receive when you deposit your funds into a liquidity pool. As you accumulate liquidity pool profits (usually as liquidity provider rewards tokens) the protocol claims the rewards, exchanges them for pool tokens and reinvest them on your behalf. The beauty of an auto compounder is that the whole process is automated.

Benefits

Auto compound protocols offer several benefits to investors.

-

Reduced Transaction Costs

The biggest benefit of auto compounding is the reduced transaction costs. When you deposit your funds into the protocol they are pooled together with funds from other investors. When rewards are compounded the pool pays for the transaction costs as a whole, socializing the gas fees across all investors. This is similar to taking a car trip with 7 people and splitting the gas costs between all 7 passengers. The reduced transaction costs means you pay less individually and you can compound more often without impacting your returns. With 100 investors in one pool, you can autocompound 100 times faster than you can as an individual and still pay the same transaction costs.

-

Fast Compounding Rates

Auto compounders allow you to compound significantly faster than if you were to do it on your own. Polycat Finance on polygon compounds their vaults every 5 minutes. If you were to do this manually the transaction fees would be quite large and you would have to sit in front of your computer all day long. Because the transaction costs are shared over a large number of investors compound this often becomes possible.

-

Tax Benefits

For most tax jurisdictions, any transaction in DeFi is considered to be a taxable event. This means that every time you claim your rewards, and re-invest them, 2 taxable events are occurring. If you are looking to reduce the number of taxable events while still compounding your returns, an autocompounder will allow you to do this. With an autocompounder, only your deposit and withdrawal would be considered as taxable events.

-

Automation

The benefit is in the name. Automation means you don’t have to sit in front of the computer and manually compound returns every 5 minutes. An auto compounder takes the thinking out of it and allows you to set it and forget it.

Risks

There are risks involved with DeFi and any smart contract. When using an auto compound protocol you must sign an additional contract and allocate your funds to the protocol. This introduces contract risk that does not exist if you were to compound your returns on your own. Prior to investing in any DeFi protocol we recommend you review the project’s white paper, audits, user reviews and check the project on RugDoc.io.

Auto Compounding Calculator

To help you decide if auto compounding is for you we have created a calculator that will compare your returns with and without an auto compounder. Be aware that the main benefit between automating the compound process and doing it manually is the reduced transaction costs and increased frequency. If you are on a low cost chain like Harmony or Polygon the benefits will be minimal. Play around with the calculator to see what the benefit of auto compounding could be on different chains with different transaction costs and for different investment sizes.

Auto Compounding Protocols

The following is a limited list of auto compounding protocols that can be found on several chains. Please be aware there is inherent risk in any DeFi investment and we recommend doing your own research prior to investing in any of these protocols. Auto compounding protocols carry additional smart contract risk versus simply investing in a liquidity pool directly. Never invest more than you are willing to lose.

Beefy Finance (Multi-Chain)

Beefy Finance is a multi-chain, decentralized yield optimizer. Using smart contracts Beefy finance earns compound interest on crypto invested in liquidity pools (LPs) by automatically reinvesting yield farming rewards tokens back into the LP pool. Vaults, their main product automatically reinvests arbitrary farm reward tokens back into the initially deposited asset. Funds are never locked and can be withdrawn at any time.

YieldYak (Avalanche)

Yield Yak helps farmers on the Avalanche ecosystem earn more yield by pooling assets and socializing the costs of compounding. Yield Yak uses a system that allows investors to compound the rewards for a given pool in exchange for a percentage of the rewards claimed. This results in optimized compounding by socializing the compounding of returns and allowing investors to actively control the process.

Yearn Finance (Ethereum & Fantom)

Yearn Finance has a suite of products available on Fantom and the Ethereum network. They provide yield generation, lending aggregation, and more. The protocol is maintained by independent developers and is governed by YFI token holders.

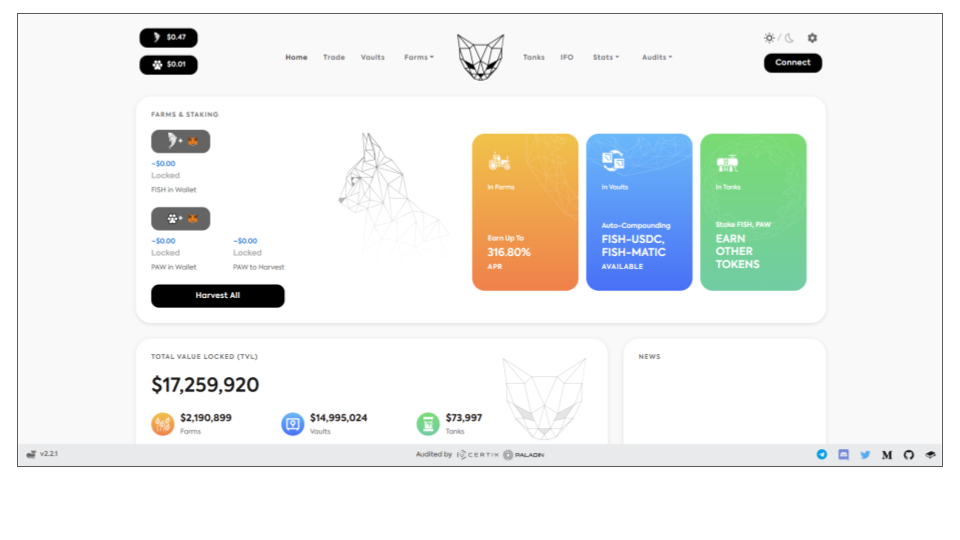

Polycat (Polygon)

Polycat is a DEX and Yield aggregator combined on the Polygon Block Chain. Started in May have 2021 Polycat Finance was one of the first yield farms on Polygon offering auto compounding vaults for many assets.

Do you auto compound your yield farming rewards? Let us know in the comments and tell us which protocol you use.

Hi I’m Mike, an active crypto investor DeFi enthusiast and crypto miner. I have been involved in crypto since March of 2021 and in DeFi since May 2021.

I’m also an avid outdoor adventurer!